Caravan Living Cost Calculator

Calculate Your Monthly Costs

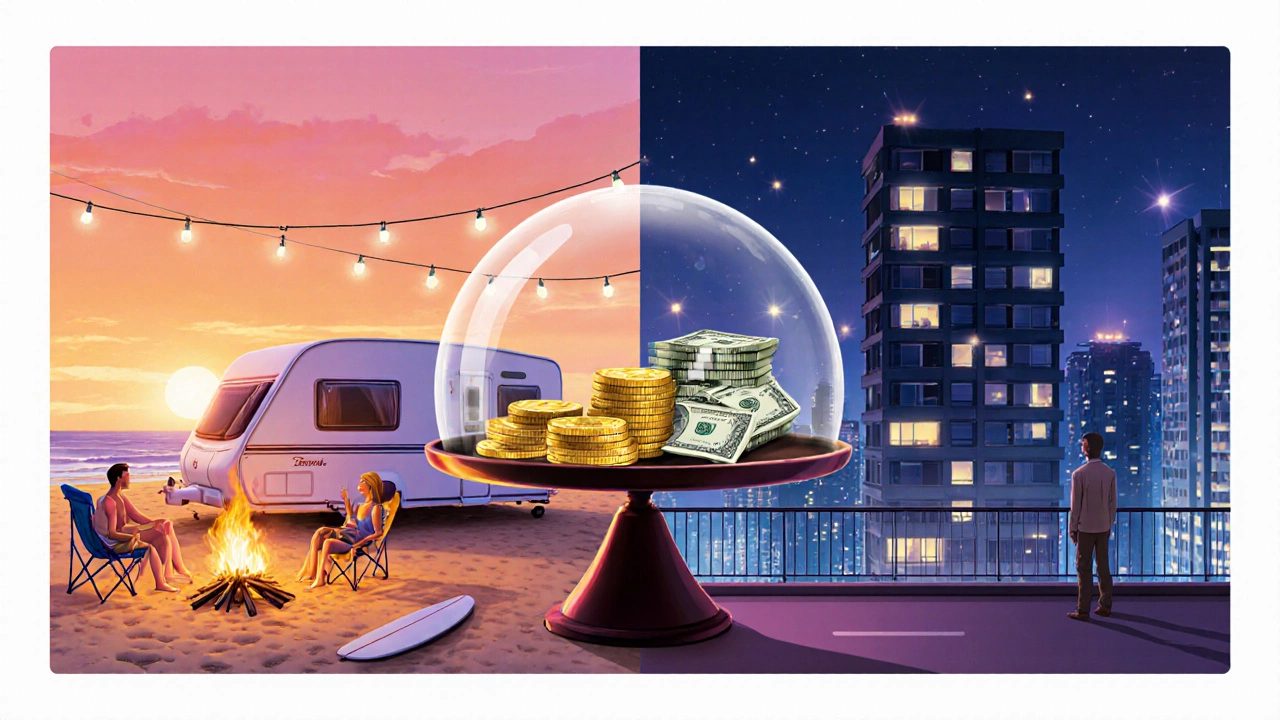

Estimate your monthly expenses for caravan living and compare to traditional housing options.

Your monthly cost is based on average Australian prices. Actual costs may vary by location and personal spending habits.

Cost Comparison

Living in a caravan can be cheaper than renting or buying, especially when you:

- Choose budget-friendly regional parks

- Invest in solar power

- Buy a well-maintained used caravan

With careful planning, your monthly cost can be as low as $1,200 or less.

Caravan living is a lifestyle where people use a portable, self‑contained home‑on‑wheels as their primary residence. It blends travel freedom with the comfort of a fixed address, letting you park at a caravan park, a private lease site, or even your own land. While the idea sounds romantic, the real question is whether it’s truly cheap compared with renting or buying a house. Below we break down every cost you’ll meet, from the upfront purchase to the daily bills, and compare them against traditional housing.

Initial Investment: Buying the Caravan

The biggest upfront expense is the caravan itself. New entry‑level models in Australia start around AU$25,000, while mid‑range family units run AU$45,000‑AU$70,000. Luxury or custom builds can exceed AU$120,000. If you buy used, you might find a decent 5‑year‑old unit for 30‑40% less, but expect higher maintenance. Treat the purchase like a small mortgage - you can finance it over 5‑7 years at 4‑6% interest, adding roughly AU$500‑AU$900 to your monthly outgo.

Site Fees: Caravan Park vs Private Land

Where you park determines a large chunk of your recurring costs. Caravan parks usually charge a weekly fee that covers a pitch, electricity, water, and waste dump. In NSW, the average is AU$250 per week (≈AU$1,000 per month). Premium parks on the coast or near major cities can hit AU$350‑AU$450 weekly.

If you lease a private plot or own land, you’ll pay a lower land lease or council rate, often AU$150‑AU$250 per month, but you’ll need to arrange your own utilities. Many long‑term renters negotiate a flat rate for electricity and water, which can lower the total to about AU$180‑AU$220 per month.

Utilities and Hook‑ups

Even when your park fee includes utilities, you’ll still face extra charges for higher usage. Typical electricity consumption for a caravan ranges 2‑4 kWh per day. At an average Australian rate of AU$0.30/kWh, that’s AU$18‑AU$36 monthly. Water is billed per kiloliter; most parks allot 2‑3 kl per week free, with excess costing AU$2‑AU$4 per kl.

On a private site you’ll set up your own solar panels, a stand‑alone battery, or connect to the grid. A modest 2 kW solar system costs about AU$2,500 upfront and can shave 50‑70% off your electricity bill after the first year.

Insurance, Registration, and Taxes

Three key recurring expenses are easy to overlook:

- Caravan insurance - comprehensive cover runs AU$600‑AU$1,200 annually, depending on value and coverage.

- Vehicle registration - a standard 2‑axle caravan costs about AU$450 per year in NSW.

- Council rates - if you own land, expect AU$300‑AU$800 per year; if you’re on a park, rates are usually bundled into the pitch fee.

These add roughly AU$150‑AU$250 per month to your budget.

Maintenance and Depreciation

Like any vehicle, a caravan needs regular maintenance: tyre replacement (AU$150‑AU$250 per set), brake servicing, seal checks, and interior wear‑and‑tear. Budget AU$100‑AU$200 monthly for routine upkeep. Depreciation is a hidden cost; a new caravan can lose 15‑20% of its value in the first three years. If you plan to sell after five years, factor a loss of around AU$5,000‑AU$10,000 into your total cost of ownership.

Additional Lifestyle Costs

Living on the move often means stronger internet needs, optional portable Wi‑Fi (AU$50‑AU$80 per month), and occasional travel of the caravan to new parks (fuel, trailer hire, or tow‑truck fees). A typical annual travel budget sits at AU$2,000‑AU$3,500.

Cost Comparison: Caravan Living vs Renting vs Buying

| Expense Category | Caravan Living | Renting a 2‑bedroom apartment | Mortgage on a median house |

|---|---|---|---|

| Housing payment | AU$1,000 - AU$1,500 | AU$1,800 - AU$2,500 | AU$2,200 - AU$3,200 |

| Utilities (electricity & water) | AU$30 - AU$80 | AU$150 - AU$250 | AU$200 - AU$350 |

| Insurance / Council rates | AU$150 - AU$250 | AU$30 - AU$60 (renter's insurance) | AU$300 - AU$600 |

| Maintenance / Depreciation | AU$150 - AU$250 | AU$0 - AU$50 | AU$0 - AU$100 |

| Internet & mobile | AU$70 - AU$100 | AU$60 - AU$90 | AU$60 - AU$90 |

| Total Approx. Monthly Cost | AU$1,400 - AU$2,180 | AU$2,090 - AU$2,950 | AU$2,760 - AU$4,240 |

The table shows that even at the high end, caravan living can be cheaper than renting a comparable apartment, and dramatically less than a mortgage. Savings grow if you own land or use a low‑cost park, but they shrink if you opt for premium locations.

When Caravan Living Is Truly Cheap

To keep costs low, focus on three levers:

- Choose budget-friendly parks. Regional or inland parks often charge half of coastal rates.

- Invest in solar. A modest solar‑plus‑battery system pays for itself in 2‑3 years by cutting electricity.

- Buy used, maintain well. A well‑kept 5‑year‑old caravan avoids depreciation and reduces purchase price.

Combine these with a frugal lifestyle-cooking at home, limiting travel, and swapping expensive gadgets for multi‑purpose tools-and the monthly outlay can dip below AU$1,200.

Hidden Costs to Watch Out For

Even the most budget‑savvy caravan dweller can be surprised by a few pricey extras:

- Site deposits. Many parks require a refundable deposit of AU$500‑AU$1,000.

- Hook‑up fees. Some parks charge per‑use fees for waste dumping (AU$10‑AU$15 each visit).

- Travel insurance. If you move the caravan between states, you may need additional cover.

- Regulatory changes. New council bylaws can increase rates or require upgrades (e.g., fire safety).

Plan for a buffer of at least AU$200 per month to cover these occasional spikes.

Is It Worth It? Lifestyle vs Money

Money isn’t the only factor. Caravan living offers flexibility: you can chase summer beach spots, avoid long commutes, and simplify possessions. For families, it can mean more outdoor playtime; for retirees, it provides a low‑maintenance way to travel the country.

If the primary goal is to stretch a budget, the numbers show it can be cheaper than conventional housing, especially when you control variables like park choice and energy use. If you value stability, a permanent home may still win despite higher cost.

How much does a basic caravan cost in Australia?

A new entry‑level caravan starts around AU$25,000, while a good‑condition used model can be found for AU$15,000‑AU$20,000. Prices vary by size, brand, and features.

What are the typical weekly fees for a caravan park?

In NSW the average weekly pitch fee is about AU$250, including electricity, water, and waste dump. Premium coastal parks can charge AU$350‑AU$450 per week.

Can I use solar power on a caravan?

Yes. A 2‑kW solar panel with a 4‑kWh battery costs about AU$2,500 and can cover most daily electricity needs, cutting grid usage by up to 70%.

What insurance do I need for a caravan?

Comprehensive caravan insurance typically costs AU$600‑AU$1,200 per year. It covers theft, fire, accidental damage, and third‑party liability.

Is caravan living cheaper than renting in major cities?

When you compare average monthly costs, a well‑chosen park plus utilities usually totals AU$1,400‑AU$2,200, whereas a two‑bedroom apartment in Sydney or Melbourne ranges AU$2,000‑AU$2,800. So yes, it can be noticeably cheaper.

What hidden costs should I budget for?

Set aside money for site deposits, waste‑dump fees, occasional travel insurance, and possible council rate hikes. A monthly buffer of AU$200 helps avoid surprises.