RV Financing: How to Pay for Your Motorhome Without Breaking the Bank

When you think about hitting the road in a motorhome, the big question isn’t just where you’ll go—it’s how you’ll pay for it. RV financing, the process of borrowing money to buy a motorhome or campervan. Also known as motorhome loan, it’s not like getting a car loan. Lenders look at your income, credit, and what kind of vehicle you’re buying—new or used—and that changes everything. Most people assume they need a huge down payment or perfect credit, but that’s not always true. In the UK, you can find lenders who specialize in RVs, and some even let you finance a used motorhome with as little as 10% down. The key is knowing what options exist before you walk into a dealership.

RV financing isn’t just about the loan itself. It’s tied to what you plan to do with the vehicle. If you’re using it for weekend getaways, you might prefer a shorter term and higher monthly payments. If you’re thinking about full-time living, you’ll need to factor in insurance, maintenance, and storage costs—things that don’t show up on the loan quote. Used motorhome financing, a common path for budget-conscious travelers who want to avoid the steep drop in value that new RVs take in the first year. Also known as second-hand camper loan, this route lets you get more features for less money, and many lenders offer the same terms as they do for new units. Then there’s the question of interest rates. Unlike car loans, RV loans often have higher rates because lenders see them as riskier. But that doesn’t mean you’re stuck. Some credit unions, especially those tied to outdoor or travel communities, offer better deals. And if you’ve got good credit, you might even qualify for a personal loan instead—which can sometimes be cheaper than a traditional RV loan.

Don’t forget about trade-ins. If you’ve got a car, van, or even a caravan sitting idle, trading it in can cut your loan amount significantly. A lot of UK motorhome dealers will work with you on this, especially if you’re buying from them. And if you’re not ready to buy yet, some companies let you rent-to-own, which gives you time to test the lifestyle before committing. RV affordability, how realistically you can manage the total cost of owning a motorhome over time. Also known as motorhome budgeting, this is where most people fail—not because they can’t get the loan, but because they didn’t plan for the hidden costs like winter storage, propane, or roadside assistance. The posts below show real stories from people who’ve done it—some saved for years, others took out a loan and paid it off in two. You’ll find guides on how to compare lenders, what to ask before signing, and how to avoid the traps that make RV ownership feel like a financial burden instead of a freedom. Whether you’re looking at a tiny campervan or a full-size motorhome, the right financing isn’t about the biggest loan—it’s about the smartest one.

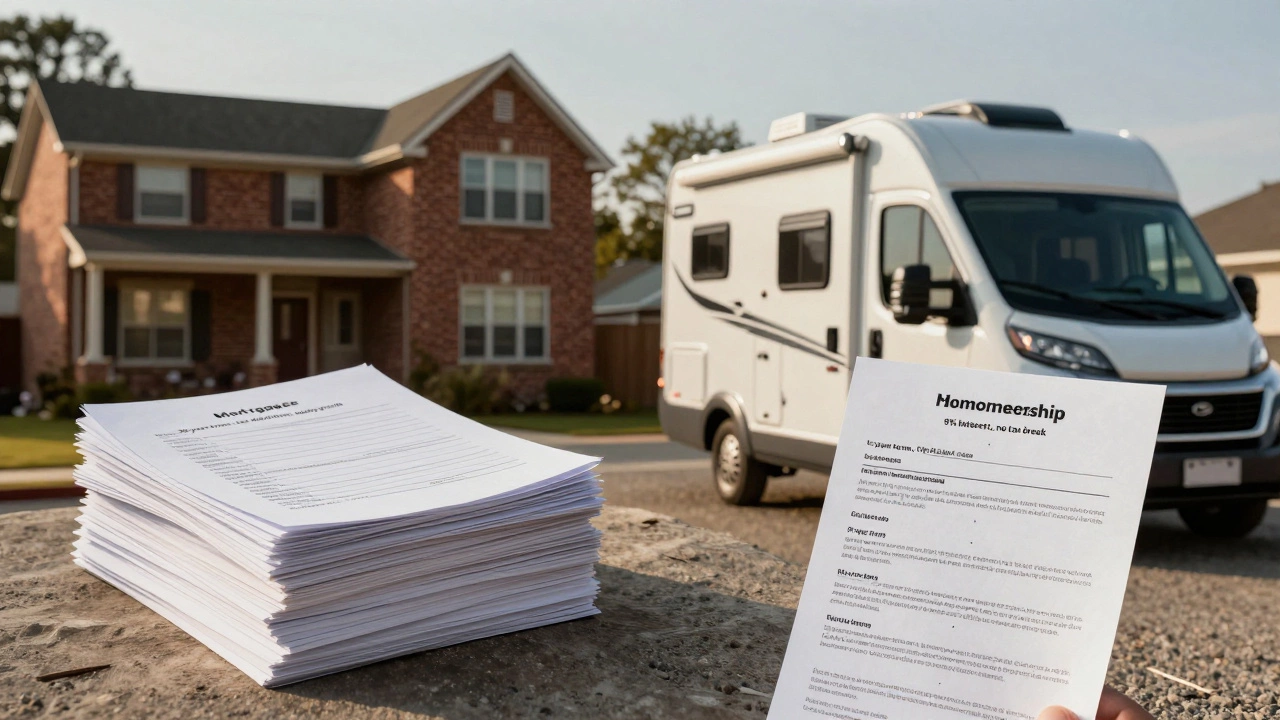

Are RV Loans Like Mortgages? Key Differences You Need to Know

RV loans aren't like mortgages - they have higher rates, shorter terms, and no tax benefits. Learn the key differences that could save you money and avoid costly mistakes when financing a motorhome.

Is it better to finance or pay cash for an RV?

Should you pay cash or finance an RV? Learn the real costs, hidden risks, and smart strategies to make the best financial choice for your lifestyle and budget.